This article will reveal all information about price to cash flow ratio.

PCF is one of the best indicator which investors used to know the real value of a company.

So, let’s dive into the ocean of the cash flow world.

What is price to cash flow ratio

Price to cash flow ratio fis just a simple indicator that measures company stock price value by its operating cash flow.

In simple words, this matrix shows us how much the value of a company shares compared to its operating cash flow per share.

P/CF is an indicator like price to earning ratio and price to sales ratio. All of those ratios fit in the same category which are used to find out the position of a company and help to supercharge investors’ decisions.

But the fact is the price to cash flow ratio is better than some of the others, especially the P/E ratio. Reason is net income can easily be manipulated by accounting methods using non cash expenses.

Whereas P/CF just includes cash flow from core operations and adds back D&A. That’s why it is not manipulated by any accounting methods.

Price to cash flow formula

Price to cash flow formula is very simple and we just need to understand two things.

- Outstanding shares

- Cash flow from operating activities

These two values are enough to find out P/CF. When you divide company outstanding share value by its operating cash flow per share you will get P/CF.

FORMULA:

price to cash flow = company’s outstanding shares ÷ operating cash flow per share

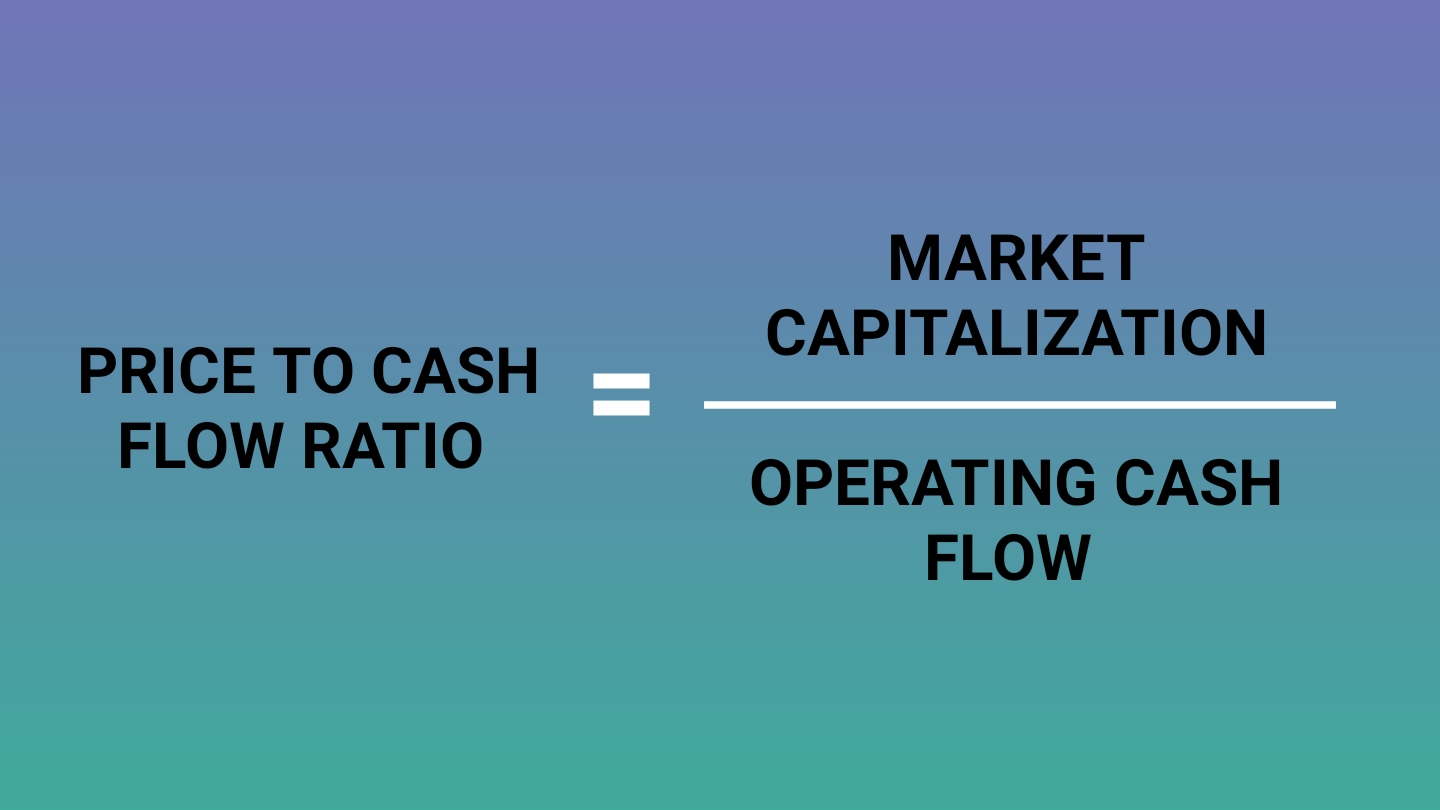

Another way is to divide market capitalization by total operating cash flow.

P/CF = market capitalisation ÷ total operating cash flow

We take the average 30 days average firm’s stock value because it may be possible to increase or decrease a little bit more value of share due to some reason (leaked data, fake news etc).

Cash flow from OA can easily be found in the cash flow statements. Non cash expenses add back in that value.

Let’s calculate the price to cash flow ratio with an example.

Price to cash flow ratio example

Assume a company named XYZ outstanding shares are 10 million and per share price is 15$. With that XYZ company’s operating cash flow is 30m$. Now using this data we can calculate price to cash flow ratio.

Operating cash flow per share (OCF/S) = 30m ÷ 10m = 3$

Now use formula:

P/CF = 15 ÷ OCF/S = 15 ÷ 3 = 5

Othe one way is to use XYZ company’s market capitalization as a parameter.

P/CF = (total shares * share price) ÷ operating cash flow = (100m*15) ÷ 300m = 5$

So we got the value of price to cash flow which is 5, it means investors are willing to pay 5 dollars for every 1 dollar operating cash flow.

Price to cash flow vs earning to cash flow

P/CF is a more attractive ratio compared to E/CF ratio because it can’t be manipulated by aggressive accounting methods. On the other hand, companies can easily manipulate E/CF using depreciation.

Cash flow statement included parameters which are related to cash inflow and outflow. means it can’t be possible to misdirect data of cash flow. So investors find a more accurate firm’s position and take its financial decision.

One step ahead, you can use price to free cash flow for better results. It neglected non-cash expenses and gave a more accurate number.

Conclusion

So, it was the full information about price to cash flow ratio.

Now your turn, do you like this post?

Tell me in the comment section.