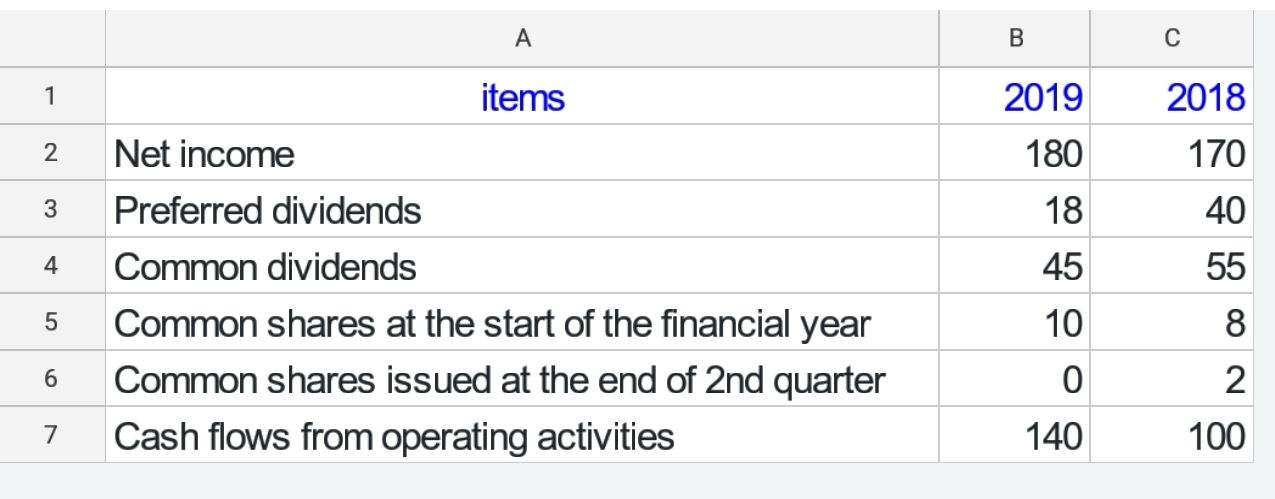

Unraveling Cash Flow per Share: Formulas and Calculations

Cash flow per share is a liquidity ratio to measure the company’s profitability by its shares.

This ratio is important to determine the liquidity and profitability of the company compared to its outstanding shares.

In this article, you will learn what cash flow per share is, its formula, how to calculate it, and an example. So let’s dive into the sea.