A non-profit balance sheet, also known as a statement of financial position, helps non-profit organizations audit their operations and assess the health of the organization.

It is different from a for-profit balance sheet, which is related to businesses focused on profit.

In this article, we will cover all details regarding the non-profit balance sheet, also known as the statement of financial position.

So let’s dive into this post.

What is a non-profit balance sheet

A non-profit balance sheet is used by non-profits, similar to how a for-profit uses a balance sheet. It includes assets, liabilities, and net assets.

In the financial world, there are three main statements to measure a business’s position:

- 1. Cash flow statement

- 2. Income statement

- 3. Balance sheet

Here, the cash flow statement indicates the inflow and outflow of cash coming to your firm or organization.

The income statement is a report of your firm’s income, starting with company revenue and then detailing all types of expenses, ultimately resulting in profit, also called the income of the company.

Whereas, the balance sheet shows all assets and liabilities belonging to the organization.

Breakdown non-profit balance sheet

The balance sheet for non-profits is a little different than a general balance sheet. Also, the statement of financial position is referred to as such for non-profits.

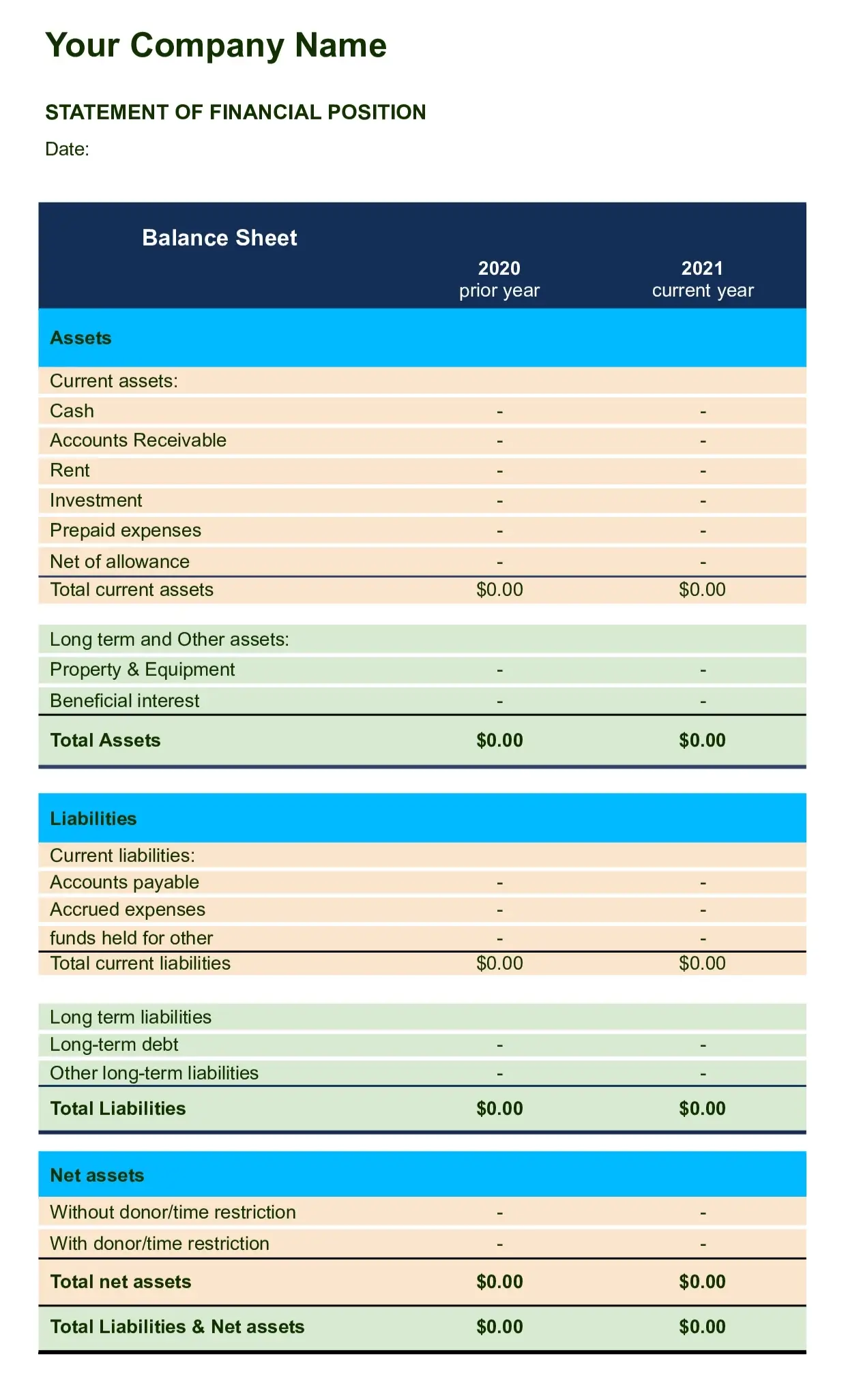

Understanding and creating a non-profit balance sheet is easy. The first step in creating the sheet is to have a template. Here’s my template; feel free to download, and you just need to fill in the data.

The Statement of Financial Position includes assets, liabilities, and net assets. Let’s discuss each part in detail.

Assets

Assets are the things that you own, ranging from property, cash, cash equivalents, land, machinery, to any digital property.

Assets are also divided into two parts based on time frame:

Current assets: assets that an organization can convert into cash within the year. This includes current cash in the account, accounts receivable within one year, cash equivalents, and machinery that can be converted into money within one year.

Fixed assets: fixed assets also known as long term assets are those that you can’t convert into cash in the short term. It includes land and property.

Now let’s move on to liabilities.

Liabilities

Liabilities are exactly the opposite of assets. What you owe is called liabilities, whereas what you own is called assets.

Liabilities include examples such as paying bills, rent, accounts payable, depreciation, and amortization. These liabilities are divided into two parts based on time:

Current liabilities: liabilities due within one year are included in current liabilities. For example, an accounts payable that comes due in one year or an amount for any type of bill or interest payment falls under current liabilities.

Long-term liabilities: as the name suggests, these are long-term payment liabilities. Bills paid in more than one year are included in long-term liabilities, also called fixed liabilities.

Net Assets

Net assets constitute the third and final section of the statement of financial position. It totals the substrate liabilities from assets, revealing how much value a non-profit organization holds. The formula for net assets is simple:

\text{Net Assets} = \text{Assets} - \text{Liabilities}In this section, there is a slight difference compared to a general balance sheet. Assets are also influenced by donors, and based on this influence, they are categorized into three parts:

Unrestricted Assets:

These assets can be used at any time and for any purpose. Organizations do not need permission or restrictions to use these assets or cash for any work. For example, if a company donates money to a school, the school can use that money for any purpose, such as a school store or school renovations.

Temporary Restricted Assets:

These assets are designated for a specific purpose and within a limited time frame. After this time, the organization is free to use these assets as they see fit. For instance, a company may donate to a school with the restriction that the funds can only be used for the garden for the next five years. After this period, the school can use the remaining funds as needed.

Permanent Restricted Assets:

This type of asset is reserved for a specific purpose and a specific duration. Regardless of how much time passes, these funds or assets cannot be used for other purposes. It’s referred to as permanently restricted. For example, a company might provide a school donation specifically for scholarships, and these funds can only be utilized for that purpose.

Non-profit Balance Sheet Example

As explained earlier regarding what a balance sheet looks like and its division into three parts, here is an example of a non-profit organization for better understanding.

Granite United Way is a non-profit organization located in Manchester, NH. If you belong to this location, you might have heard about it.

This organization receives donations from government and private sectors, which are then utilized for initiatives in learning and health.

Here is its statement of financial position, also known as the balance sheet, for the year 2022.

The first section is divided into assets, where we show current assets first, followed by other assets. In this sheet, the organization creates two columns to indicate both types of donations: restricted and non-restricted.

The first column indicates donations without donor/time restrictions, while the second column indicates donations with donor/time restrictions. The third column represents the total of both.

The next section of the sheet includes both liabilities and net assets. If you want a separate section for net assets, feel free to do so.

In the sheet, both liabilities are mentioned: current liabilities and long-term liabilities. Both include items related to their respective sections. For example, in the current part, current debt is included, and in the long-term liabilities part, long-term debt is mentioned.

After that, below net assets are mentioned. As explained earlier, they are divided into parts: restricted and not restricted. In the end, it shows how much the organization has in assets, including cash and cash equivalents.

In this balance sheet, the financial position of the previous year, 2021, is also mentioned. Based on this information, we can easily compare the organization’s performance and overall health.

Granite United Way’s net assets increased from 7.9 million to 10.9 million in one year, indicating an increase in donations and the organization’s positive impact.

Difference between Non-profit vs For-profit

While the non-profit balance sheet is almost the same as the general for-profit business balance sheet, both are used to determine the health and financial position of an organization. However, there are still some differences that are helpful when creating a statement of financial position. Here are some of the distinctions:

1. Equity vs Net Assets:

The initial two parts of the balance sheet, assets, and liabilities, are the same in both non-profit and for-profit organizations. However, the last part differs. In a for-profit organization, the balance sheet calculates equity, while in a non-profit organization, the financial position has a net assets section since there are no public shareholders.

2. Growth vs Transparency:

Both for-profit and non-profit organizations create balance sheets for the same purpose: assessing financial health. However, the balance sheet of for-profit organizations focuses on providing data to shareholders and investors about company growth to attract and build trust. In contrast, non-profit organizations need to provide donation information to donors for transparency purposes, building trust between the non-profit and the donor.

3. Shareholders vs Donors:

For-profit organizations often have shareholders who hold financial stakes in the company. In contrast, non-profit organizations run based on donations, making donors crucial as they financially support the organization.

Conclusion

This overview provides information about the non-profit balance sheet. Now it’s your turn – did you find this post helpful? Share your thoughts in the comment section.